Articles

Cycle 3 Plan Document Restatements

Approximately every six years, the IRS requires that pre-approved qualified retirement plans update (or restate) their plan document to reflect recent legislative and regulatory changes. Plan restatements are divided into staggered six-year cycles depending on the...

The CARES ACT Update

2020 has been a difficult year with many unexpected challenges. For companies that sponsor retirement plans, some of these challenges came in the form of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. While the CARES Act provided much needed relief to...

Required Year-End Participant Notices

As the end of the year approaches, our to-do lists become longer but our bandwidth becomes condensed. To compound matters, when you sponsor a retirement plan, you know you will be in close contact with your TPA firm about the various year-end notices that must be...

Upcoming Compliance Deadlines for Calendar-Year Plans

Upcoming Compliance Deadlines for Calendar-Year Plans 1st December 2020 Participant Notices – Annual notices due for safe harbor elections, Qualified Default Investment Alternatives (QDIA), and Automatic Contribution Arrangements (EACA or QACA). 31st ADP/ACP...

The SECURE Act Reminders

With so much discussion surrounding the CARES Act, it is easy to forget that 2019 brought us some of the most significant changes to retirement plan law since the passage of the Pension Protection Act of 2006. This legislation came to us by virtue of The Setting Every...

Cost of Living Adjustment for 2021

On October 26, 2020, the IRS announced the Cost of Living Adjustments affecting the dollar limitations for retirement plans. Contribution and benefit increases are intended to allow participant contributions and benefits to keep up with the “cost of living” from year to year. Here are the highlights from the 2021 limits: The elective deferral limit remains unchanged at $19,500. This deferral limit applies to each participant on a calendar year basis. The limit applies to 401(k) …

New Plan Tax Credits

When we talk about new retirement plans, we usually focus on the savings advantages they grant to business owners or the big-picture advantages of helping employees achieve ongoing financial wellness. Tax credits granted to plan sponsors are another important, but...

Electronic Delivery Could Save Billions

On May 21, 2020, the U.S. Department of Labor and the Employee Benefits Security Administration (EBSA) announced the publication of a final rule that will allow employers to communicate the required retirement plan disclosures and other plan information electronically. The rule finishes a 2018 DOL initiative aimed at reducing administrative burdens and costs associated with the delivery of retirement plan disclosures. EBSA projects that electronic delivery could save retirement plan sponsor…

IRS Issues Additional Pandemic Relief

On June 29, 2020, the IRS issued Notice 2020-52 in response to the COVID-19 pandemic providing welcome relief to plan sponsors who are considering suspending safe harbor contributions and also to those who may already have regardless of whether the employer is suffering an economic loss. The notice is significant in that it permits employers who sponsor 401(k) plans to reduce or suspend their safe harbor contributions and redirect those funds to other, more urgent needs. However…

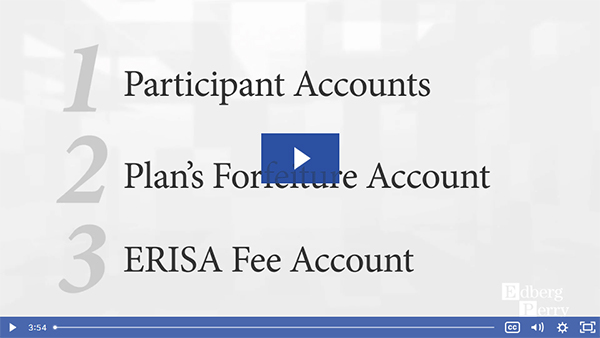

Paying Fees from Plan Assets

COVID-19 is obviously causing financial stress and, when it comes to your clients’ qualified retirement plans, they may be looking for ways to reduce expenses. In this talk, we’ll detail the three options they have to use plan assets to pay some plan expenses as long...

How the CARES Act Applies to Your Retirement Plan

IMPORTANT HIGHLIGHTS The Coronavirus Aid, Relief and Economic Security (CARES) Act includes provisions that may apply to your retirement plan. Here are some important highlights to know first. The CARES ACT expands and relaxes rules on withdrawals, participant loans,...

Understanding the CARES Act

On Friday, March 27, 2020, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), a massive relief bill for those suffering as a result of the Coronavirus pandemic, was signed into law. Besides the generalized financial relief afforded to individuals, as well as loans and other concessions for businesses, the bill includes the following provisions to help participants and employer sponsors of retirement…